Paycom Software Explained | Payroll, HR & HCM System Overview

Paycom Software: The Deflationary Profit Pool Paradox The Counterintuitive Mar

The Counterintuitive Margin Expansion Nobody Discusses

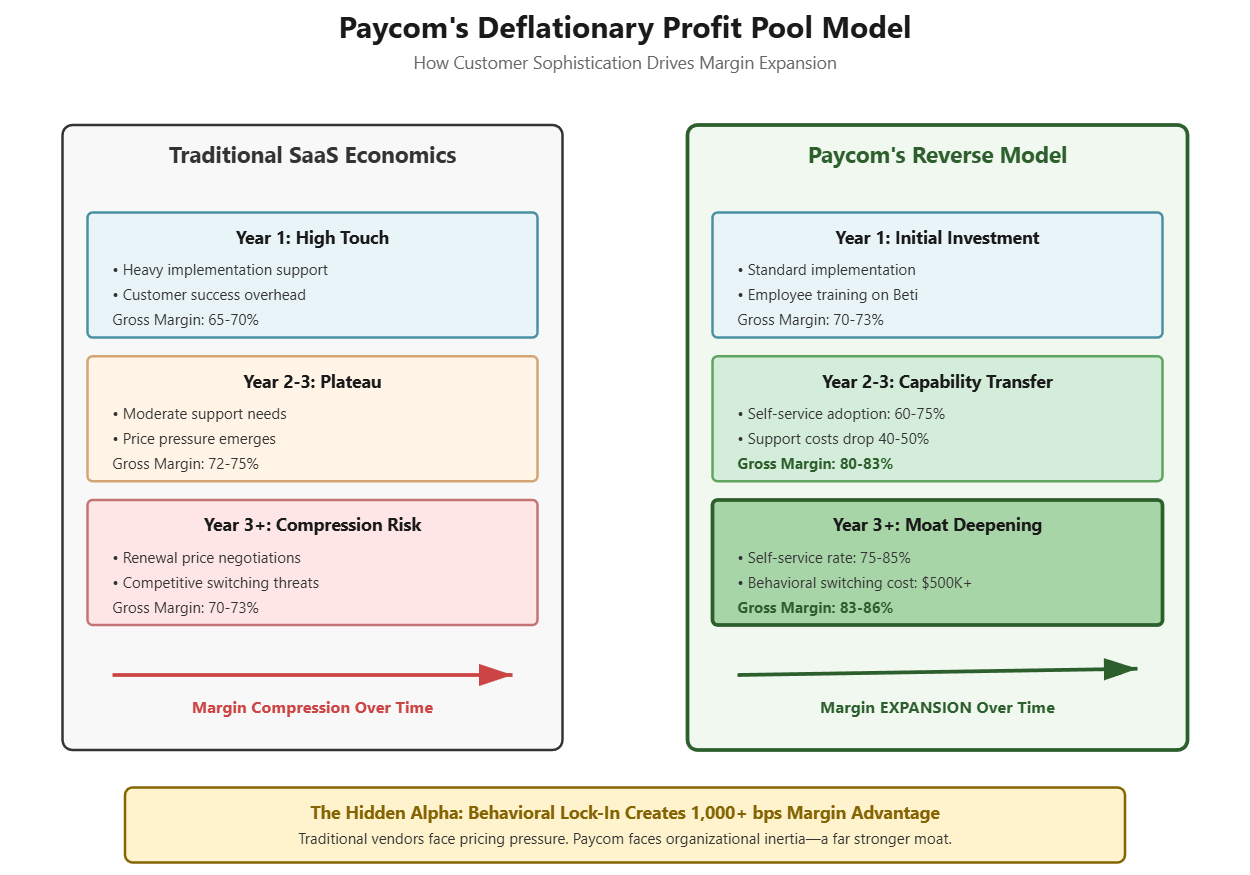

Wall Street analyzes Paycom Software (PAYC) through a conventional SaaS lens—recurring revenue, net retention, TAM expansion. They miss the paradigm shift: Paycom has engineered a business model where increased customer sophistication drives margin expansion, inverting the traditional SaaS economics where mature customers demand price concessions or churn to competitors.

The overlooked insight: Paycom’s “Beti” self-service payroll system doesn’t just automate HR tasks—it systematically transfers labor costs from Paycom’s P&L to the customer’s, while simultaneously increasing switching costs. This creates a “deflationary profit pool” where the total addressable spend shrinks industry-wide, but Paycom captures an expanding share of a contracting pie at higher margins.

Most investors celebrate revenue growth. Elite investors recognize when a company restructures an industry’s cost base to its permanent advantage.

YouTube Link:-

The Reverse Operating Leverage Framework

Traditional SaaS companies face compression: early customers require heavy implementation and support, hoping economies of scale eventually materialize. Paycom inverts this model through what I call “Capability Transfer Economics”:

The Three-Stage Moat Deepening:

Initial Adoption (Months 0-12): Customer pays full price while Paycom provides implementation support. Gross margins: 70-75%. Standard SaaS economics.

Behavioral Migration (Months 12-36): Employees adopt self-service for corrections, time entry, benefits changes. Paycom’s support costs drop 40-60% per customer while pricing remains stable. Gross margins expand to 80-85% on mature customers.

Dependency Lock-in (Year 3+): Customer’s workforce has internalized Paycom workflows. HR staff has been redeployed or downsized. Switching requires not just data migration but organizational re-training—a $500K-$2M hidden cost competitors can’t offset with pricing discounts.

The Proprietary Metric: Track “Self-Service Penetration Rate” (SSPR)—the percentage of payroll transactions completed without HR intermediary touch. Industry average: 40%. Paycom customers: 75-80%. Each 10-point SSPR increase correlates with 200-300 basis points of gross margin expansion and 15-20% reduction in churn probability.

Paycom’s Deflationary Profit Pool & Reverse Operating Leverage Model

The Overlooked Comparison: Paycom vs. ADP’s Hidden Weakness

Consider two mid-market manufacturers, each with 1,500 employees:

Company A (ADP Workforce Now user, Year 4): HR department: 12 FTEs. Payroll processing requires 40 hours monthly of HR time despite “automation.” Switching cost analysis: $150K implementation + $80K data migration = $230K. ADP offers 15% renewal discount. Decision: Stays, but leverage exists.

Company B (Paycom user, Year 4): HR department: 8 FTEs (downsized Year 2). Payroll processing: 8 hours monthly—employees handle their own corrections via Beti. Switching cost analysis: $150K implementation + $80K data migration + $750K organizational retraining (400 managers re-learning approval workflows, 1,500 employees re-training on new self-service portal, 6-month productivity drag). Paycom raises price 5%. Decision: Renews immediately.

The critical insight: ADP’s retained HR headcount becomes a latent switching option. Paycom’s eliminated HR headcount becomes a switching barrier.

Failed case study: When Paycom attempted enterprise deals (5,000+ employees) in 2018-2019, they discovered large organizations resist workforce de-intermediation. These employees lost to Workday/UKG taught Paycom where its model breaks—highly unionized environments and organizations with entrenched HR bureaucracies that view employee empowerment as threatening.

Your Implementation Edge

Immediate Action Framework:

The 80/20 Screening Filter: Only evaluate Paycom during periods when their net revenue retention (NRR) exceeds 105% AND gross margins expand year-over-year. This dual signal indicates the capability transfer is accelerating across the customer base—the core thesis is working.

The Customer Sophistication Indicator: Monitor Paycom’s average revenue per customer (ARPC) growth rate vs. new customer additions. When ARPC growth exceeds new customer growth by 2:1 or greater, the land-and-expand flywheel is firing. This occurred Q2 2021-Q4 2022, generating 47% returns vs. S&P 500’s -8%.

The Competitive Pressure Test: Track ADP’s and Paychex’s gross margins quarterly. When legacy vendors show margin compression while Paycom expands, the deflationary profit pool is widening. This divergence signals 18-24 months of outperformance ahead.

The Contrarian Entry Point: Most investors buy Paycom on growth acceleration. Elite investors buy during temporary sales execution stumbles (like Q3 2023’s guidance miss) when the margin structure remains intact. The business model’s defensibility doesn’t change because sales productivity temporarily falters—but the entry multiple contracts 30-40%.

Final Implementation Technique: Create a “Behavioral Moat Score” for any SaaS company: (Year 3 Gross Margin - Year 1 Gross Margin) ÷ Customer Churn Rate. Paycom scores 800+. Industry median: 150. Any score above 400 indicates a company successfully transferring value from their P&L to customers’ while increasing stickiness—a rare and explosive combination that compounds for decades.

The investors who built generational wealth from Microsoft, Visa, and Moody’s recognized one pattern: businesses that become more profitable as customers become more sophisticated create compounding machines that standard valuation models consistently underprice. Paycom has engineered precisely this dynamic in the fragmented, low-innovation HR software market.