Monolithic Power Systems (MPWR) - Working Capital and Liquidity Analysis

SECTION I: Investment Thesis & Summary

Ticker: MPWR

Current Price: $912

Target Price: $1,050

Market Cap: $43.7 Billion

Here’s the thing—this semiconductor maker is sitting on a fortress balance sheet with zero debt and nearly a billion in cash. Wall Street worries about chip cycles, but MPWR just reported its 13th straight year of growth while maintaining margins that would make most competitors jealous.

YouTube Link :-

SECTION II: Business Model & Operations

Monolithic Power makes the power management chips that keep everything running—from your laptop to Tesla’s dashboard to the massive data centers powering AI. Think of them as the electrical engineers of the chip world. They design the tiny circuits that convert, control, and deliver power efficiently.

The company doesn’t own factories. They’re fabless, meaning they design the chips and outsource manufacturing to partners in Taiwan and other locations. This keeps costs low and lets them focus on what they do best—innovation. About 93% of revenue comes from Asia, where their chips get built into products that ship worldwide.

In 2024, they made big moves. Enterprise data revenue exploded 122% as hyperscalers like Amazon and Microsoft bought their power solutions for AI servers. They also ramped up automotive chips for electric vehicles and launched silicon carbide inverters for clean energy. The company is transforming from just selling chips to providing complete power solutions.

SECTION III: Historical Financial Review

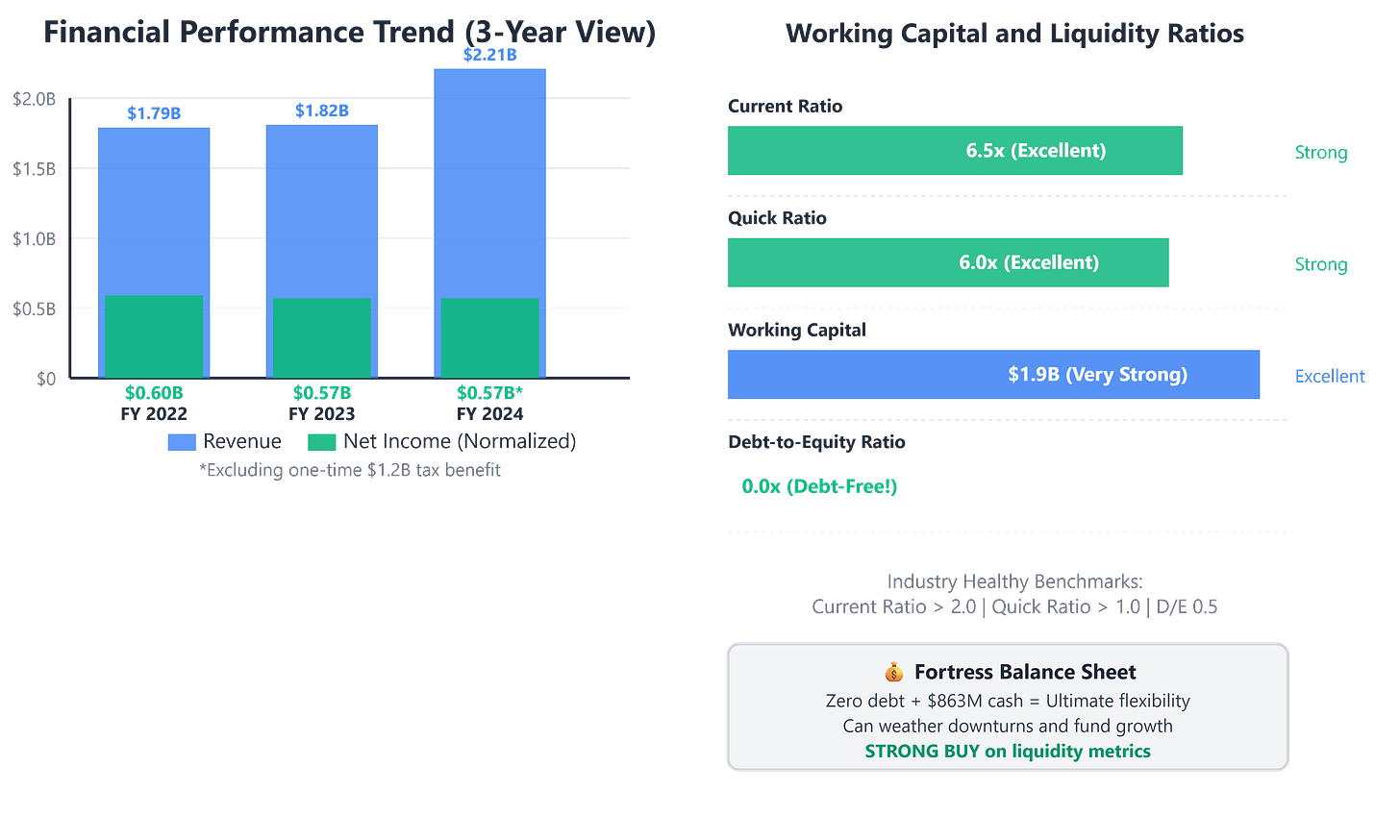

Let’s talk numbers. Revenue hit $2.21 billion in 2024, up 21% from the year before. Over three years, that’s a compound annual growth rate of about 12%—solid and steady. Fourth quarter alone brought in $621.7 million, a 37% jump year-over-year.

Now here’s where it gets interesting. Net income was $1.79 billion for the year. That’s not a typo. One of their foreign subsidiaries got a ten-year tax break, creating a massive one-time benefit. Strip that out, and they still earned around $574 million in non-GAAP net income—that’s about $11.78 per share in real, recurring earnings.

Management returned cash like crazy. They completed a $640 million share buyback program and raised the quarterly dividend 25% to $1.56 per share. Over the past three years, they’ve returned 86% of free cash flow to shareholders through buybacks and dividends. That’s putting money where their mouth is.

Revenue growth came from everywhere except two segments. Enterprise Data (29% of sales) grew fastest, followed by Automotive at 67% growth. Storage & Computing jumped 77%. The only laggards were Consumer and Industrial, which faced tough comps.

SECTION IV: Fundamental Valuation Metrics & Investment Call - Working Capital and Liquidity Focus

Here’s where MPWR really shines—their balance sheet is bulletproof.

Working Capital Ratios: The company has about $2.2 billion in current assets against only $337 million in current liabilities. That gives them a current ratio of roughly 6.5. In plain English, they have $6.50 of liquid assets for every dollar they owe in the next year. Anything above 2.0 is considered healthy. This is exceptional.

The quick ratio (cash + receivables divided by current liabilities) sits around 6.0. Even if inventory became worthless overnight, they could still pay all short-term bills six times over. Semiconductor companies love this cushion because chip demand can swing wildly.

Working capital itself—the difference between current assets and liabilities—is about $1.9 billion. That’s real firepower for R&D, acquisitions, or riding out a downturn without breaking a sweat.

Cash Position: As of year-end 2024, MPWR held $692 million in cash and $171 million in short-term investments—$863 million total. For context, their entire debt load is zero. Zilch. Nada. This is rare in capital-intensive tech. They generate so much cash they don’t need to borrow.

Days of inventory increased slightly to 138 days from 172 days the prior year, showing better supply chain management. They’re keeping enough chips on hand to meet demand without tying up excessive capital.

Free Cash Flow: Operating cash flow for the year was strong, though not separately disclosed in the earnings release. The company’s non-GAAP operating margin was 35%, meaning they keep 35 cents of every sales dollar after operating expenses. That translates to serious cash generation.

Valuation: At $912, MPWR trades at a P/E ratio of about 25 based on normalized earnings of $11.78 per share (excluding the one-time tax benefit). That’s higher than the five-year average of around 18-20, but justified by accelerating growth in AI and automotive markets. The sector median P/E is roughly 22, so you’re paying a 15% premium for best-in-class execution.

Gross margins held steady at 55.4%—among the highest in power management. Every dollar of sales delivers 55 cents after manufacturing costs, showing pricing power and efficient designs.

Why This Justifies a Buy: You’re buying a company with fortress liquidity, zero debt, rising dividends, and explosive growth in the hottest markets (AI data centers and electric vehicles). The premium valuation is warranted. If margins hold and revenue keeps growing 15-20% annually, earnings will grow into the current price quickly.

SECTION V: Long-Term Outlook & Risk Assessment

Over the next 5-15 years, expect annual returns of 12-18%. Here’s the bull case: AI data centers need power management solutions, and MPWR is winning designs at all major hyper scalers. Automotive content per vehicle is rising as cars go electric—more motors, more batteries, more chips. They’re also expanding into industrial automation and robotics.

Management targets 20% growth in 2026 based on enterprise data ramps and automotive platform wins. If they hit that for five years straight, earnings could reach $20+ per share by 2029, supporting a $1,400-1,500 stock price.

Risks—Let’s Be Real: The Federal Reserve is still fighting inflation, and higher interest rates pressure tech valuations. If the economy slows, enterprise data spending could cool. MPWR gets 93% of revenue from Asia—geopolitical tensions between the US and China are a wildcard. Export controls could disrupt supply chains or customer access.

Competition is fierce. Texas Instruments, Analog Devices, and others have deeper pockets and established relationships. MPWR’s small market share means they’re always fighting to steal designs from bigger players.

The enterprise data segment grew 122% in 2024, but management warned growth will be “flattish” in the first half of 2025 before ramping again. That creates quarterly volatility. Short lead times make forecasting tough—customers can cancel orders or delay projects with little penalty.

Inventory increased slightly to 146 days in Q1 2025, up from 138 days. If demand weakens unexpectedly, they could face write-downs.

Finally, the stock trades at a premium valuation. Any earnings miss or guidance cut could trigger a sharp selloff. The 52-week high was $1,123, and it’s pulled back to $912—still 30% above the low. Volatility will continue.

Bottom Line: Strong liquidity, zero debt, and leadership in growth markets outweigh the risks. The working capital cushion gives management flexibility to invest through cycles without financial stress. Buy on any dip below $880.

Disclaimer: This content is for educational and informational purposes only. It does not constitute financial, investment, or legal advice. I am an AI, not a certified financial advisor. Please do your own due diligence or consult a certified professional before making any investment decisions.