Balance Sheet Breakdown: Assets, Liabilities, Equity

The balance sheet is your financial X-ray machine. While income statements tell you how a company performed over time, the balance sheet captures its financial position at a single moment—revealing what a company owns, owes, and how much investor capital remains.

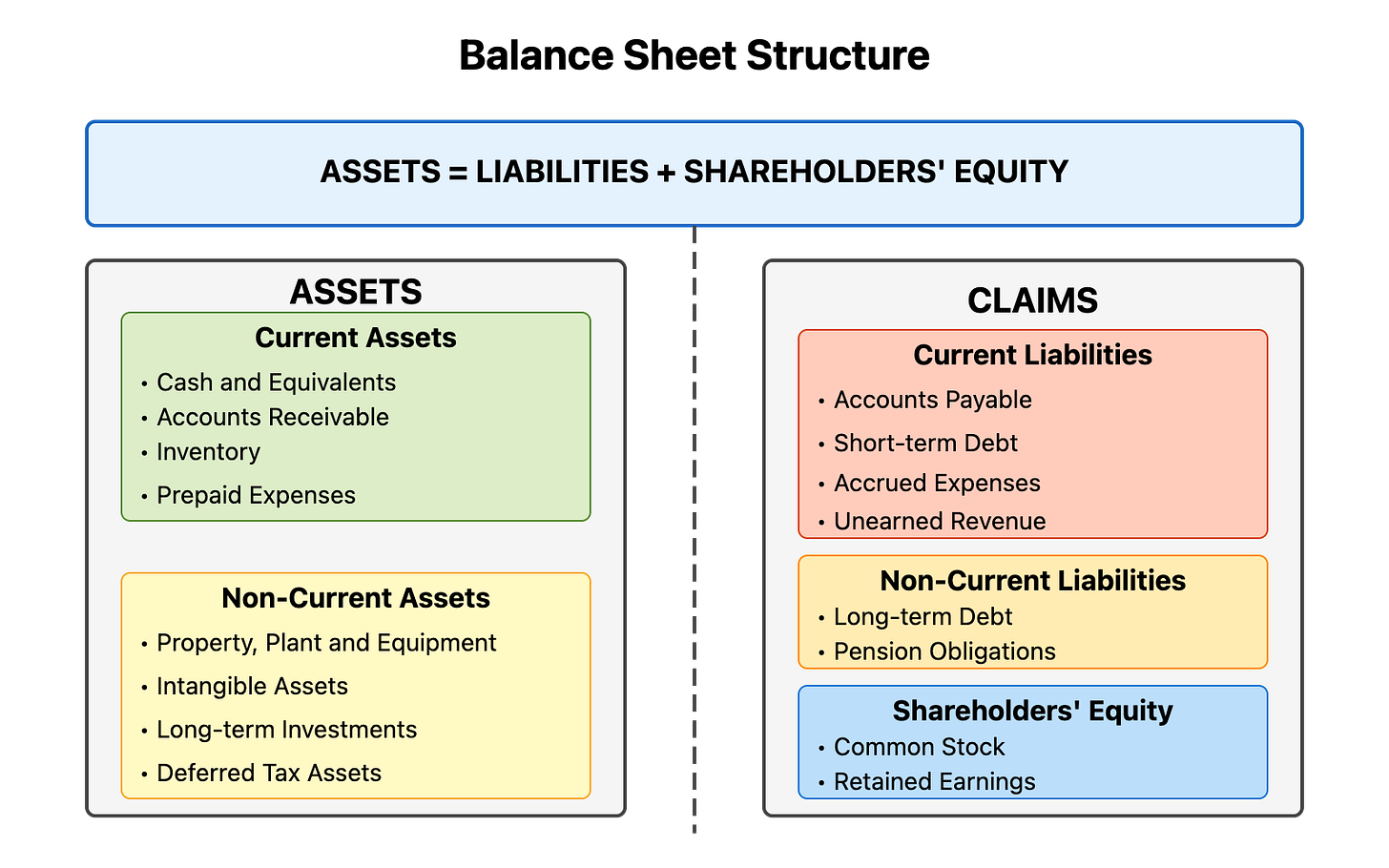

Understanding the Basic Structure

Every balance sheet follows a fundamental equation:

Assets = Liabilities + Shareholders' Equity

This equation must always balance—hence the name. Let's break down each component:

Assets

Assets represent everything a company owns or controls that has economic value. They're typically arranged by liquidity (how quickly they can be converted to cash):

Current Assets: Items convertible to cash within one year

Cash and equivalents

Short-term investments

Accounts receivable

Inventory

Prepaid expenses

Non-Current Assets: Longer-term investments

Property, Plant & Equipment (PP&E)

Intangible assets (patents, trademarks, goodwill)

Long-term investments

Deferred tax assets

Liabilities

Liabilities represent everything a company owes to outside parties:

Current Liabilities: Obligations due within one year

Accounts payable

Short-term debt

Current portion of long-term debt

Accrued expenses

Unearned revenue

Non-Current Liabilities: Obligations due beyond one year

Long-term debt

Pension obligations

Deferred tax liabilities

Lease obligations

Shareholders' Equity

Equity represents the net value belonging to shareholders after subtracting liabilities from assets:

Common and preferred stock

Additional paid-in capital

Retained earnings

Treasury stock (a reduction)

Accumulated other comprehensive income/loss

Balance Sheet Structure

Practical Balance Sheet Analysis for Investors

When evaluating potential investments, focus on these key balance sheet metrics:

1. Liquidity Ratios

Current Ratio = Current Assets ÷ Current Liabilities

Healthy range: 1.5-3.0

Apple's ratio: 1.36 (solid for its industry)

Microsoft's ratio: 1.65 (strong positioning)

2. Leverage Ratios

Debt-to-Equity = Total Debt ÷ Shareholders' Equity

Lower values indicate less financial risk

Toyota: 1.07 (industry-appropriate leverage)

Nestlé: 0.58 (conservative positioning)

3. Asset Quality

Return on Assets (ROA) = Net Income ÷ Total Assets

Measures management efficiency using assets

Higher values indicate better asset utilization

Practical Application for Long-Term Investors

When analyzing a company for generational wealth creation, conduct this balance sheet assessment:

Debt Health Check: Compare debt levels to industry peers and examine trends over 5-10 years.

Asset Growth Quality: Determine if asset growth comes from productive investments or wasteful acquisitions.

Working Capital Efficiency: Calculate how efficiently the company converts working capital into sales.

Equity Growth Pattern: Look for consistent, organic growth in shareholders' equity rather than financial engineering.

Off-Balance Sheet Obligations: Scrutinize footnotes for leases, guarantees, or contingent liabilities that could become future problems.

Real-World Example: Microsoft vs. GameStop

Microsoft's balance sheet reveals its fortress-like financial position:

Cash reserves exceeding $100 billion

Debt-to-equity ratio below 0.5

Consistently growing shareholders' equity

This contrasts with GameStop, which has:

Declining physical assets (retail locations)

Volatile working capital requirements

Less predictable equity growth

Microsoft's balance sheet strength provides:

Ability to weather economic storms

Capacity for strategic acquisitions

Resources for R&D and shareholder returns

These elements make Microsoft a potential cornerstone holding for generational wealth portfolios.

Your Next Steps

Pull up balance sheets for three companies you're interested in.

Calculate their current and debt-to-equity ratios.

Compare their asset composition and liability structures against industry peers.

Look for consistent patterns of equity growth over a decade or longer.

Remember: Balance sheets tell stories about management philosophy, capital allocation skill, and financial resilience. Learning to read these stories might be the most valuable skill you develop as a long-term investor building generational wealth.